Effective Cash Flow Management Techniques for Seasonal Businesses

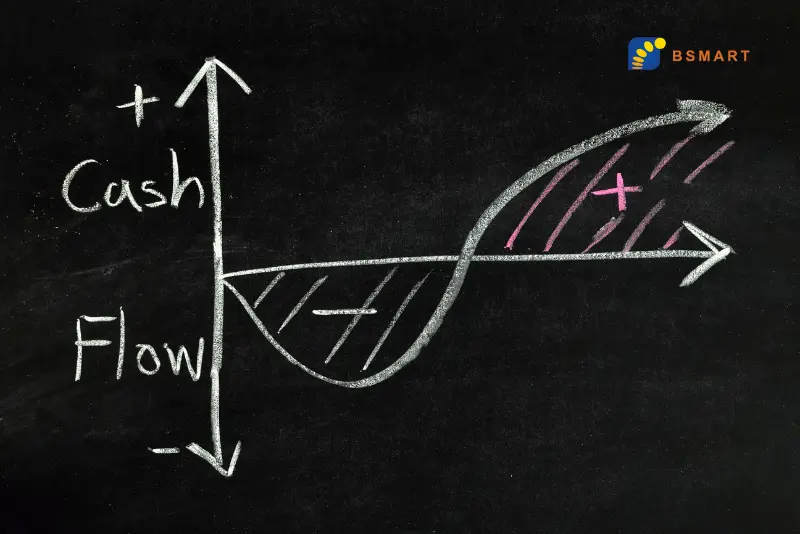

Seasonal businesses, marked by their distinct revenue patterns, encounter specific financial management challenges. Different from businesses that have consistent income throughout the year, these enterprises often see a substantial part of their earnings concentrated in short, intense periods. This variability in income can lead to considerable difficulties in managing cash flow. Grasping these challenges and effectively addressing them is crucial for the sustainability and prosperity of any seasonal business.

Let’s look at some of the practical cash flow management techniques designed specifically for seasonal businesses.

Understanding Seasonal Cash Flow

Understanding seasonal cash flow is crucial for businesses in India, where income often fluctuates with seasons, festivals, and agricultural cycles. For example, Diwali firecracker manufacturers typically experience a surge in sales during the festival but see a decline in demand afterwards. Similarly, agricultural businesses dependent on the monsoon season may earn well during harvest but struggle in dry periods. Tourism services in hill stations often peak during summer when people escape the heat of the plains. Recognizing these patterns is important for businesses to plan their financial strategies effectively.

To manage these fluctuations, businesses need to do more than just identify busy and slow periods. They should analyze when and how income will be generated and align their expenses accordingly. This involves setting aside funds during profitable times to cover costs in lean periods and timing major expenses to coincide with periods of high cash flow. Additionally, staying aware of external factors like economic changes, shifts in consumer behavior, or unusual weather patterns is important in the Indian market, as these can significantly impact seasonal cash flow.

Forecasting and Budgeting

Forecasting and budgeting are key to managing cash flow in seasonal businesses. The process begins with a thorough review of past sales, focusing on performance during peak times like festivals or specific seasons. It’s essential to analyze not only sales volumes but also which products or services were most popular and how external factors such as economic shifts or unusual events impacted sales. This historical insight is invaluable, providing a clear picture of what might be expected in future seasons.

Alongside this historical analysis, businesses must also consider current market trends and make informed predictions about the upcoming season. This might involve understanding changing customer preferences, keeping an eye on emerging competitors, or considering broader economic trends that could influence consumer spending. With this knowledge in hand, businesses can then develop a comprehensive budget that addresses both fixed costs, like rent and salaries, and variable costs, such as additional inventory purchases during busy periods. By incorporating both past insights and future projections, the budget becomes a strategic tool to ensure financial stability throughout the year, regardless of seasonal sales fluctuations.

Strengthening the Off-Season

Strengthening the off-season involves finding ways to keep income flowing even when your main business isn’t in its peak period. One effective approach is to introduce new products or services that are in demand outside of your usual busy season. For instance, a business that does well during a particular festival could explore products that cater to other events or needs throughout the year. This diversification can help attract a consistent flow of customers, reducing the reliance on one peak season for the majority of revenue. Additionally, businesses can explore partnerships or complementary services that align with their existing offerings, further expanding their market reach during slower periods.

The off-season also provides an excellent opportunity to focus on marketing and preparation for the busy times ahead. This is the time to build your brand, connect with customers, and create buzz around what’s coming up. It’s a good period to engage with customers through social media, email newsletters, or community events. By strengthening customer relationships and brand loyalty during the off-season, businesses can lay a solid foundation for increased sales when the peak season arrives. Additionally, this period can be used for strategic planning, staff training, and improving operational efficiencies, ensuring the business is well-prepared to capitalize on the upcoming busy period.

Managing Inventory Efficiently

Efficient inventory management is a crucial aspect for seasonal businesses. The key is to have the right amount of stock at the right time. To achieve this, businesses need to closely align their inventory with predicted sales. This means having enough products to meet customer demand during the peak season but not so much that you’re left with excess stock when the demand drops. Overstocking ties up capital in unsold goods and increases storage costs, while understocking can lead to missed sales opportunities.

One effective strategy to manage inventory efficiently is the just-in-time (JIT) approach. This method involves keeping inventory levels as low as possible and ordering stock only when it’s needed. This way, businesses can reduce the costs associated with holding large amounts of inventory, such as storage and insurance. JIT requires a good understanding of your supply chain and careful planning to ensure that new stock arrives just in time to meet customer demand.

Smart Financing Options

Access to flexible financing options can be a critical support system for seasonal businesses during their low-revenue periods. Tools like lines of credit, short-term loans, or merchant cash advances offer the financial backing needed to navigate through lean times. A line of credit, for instance, allows businesses to draw funds as needed up to a certain limit, making it a versatile solution for managing day-to-day expenses and cash flow gaps. This option is particularly beneficial as businesses only incur interest on the amount they use, allowing for more control over their financial obligations.

On the other hand, short-term loans provide a lump sum of money that is repaid over a short duration, often within a year. They are ideal for specific, short-term needs like purchasing inventory or funding a marketing campaign for the upcoming peak season. Merchant cash advances are another viable option for businesses with considerable credit card transactions, offering a lump sum in exchange for a portion of future sales. However, it’s vital for business owners to thoroughly understand the terms, such as interest rates and repayment schedules, of these financial products to ensure they select the most beneficial and cost-effective option.

Improving Receivables

Improving the management of receivables is a key technique for maintaining a healthy cash flow, especially in seasonal businesses. One effective approach is to encourage quicker payments from customers. This can be achieved by offering incentives for early payment, such as discounts or special terms for those who pay their invoices ahead of time. Not only does this strategy accelerate cash inflow, but it also helps build customer loyalty. Additionally, setting clear payment terms from the outset is crucial. These terms should be communicated clearly and consistently to all customers, ensuring they understand when payments are due and what the consequences are for late payments.

For larger projects that extend over a long period, progress billing is an excellent tool for maintaining steady cash flow. This involves billing customers in installments at different stages of a project, rather than waiting until the project’s completion to invoice for the entire amount. This method ensures a regular flow of cash into the business, which is particularly important for managing expenses and maintaining operations during the project. It also reduces the financial risk associated with long-term projects by providing ongoing revenue, rather than relying on a single payment post-completion. Adopting these strategies for receivables management can significantly improve the financial stability of a seasonal business, smoothing out cash flow irregularities inherent in such business models.

Building a Cash Reserve

Building a cash reserve is a critical strategy for seasonal businesses, offering a safety net during times when cash flow is limited. This reserve serves as a financial cushion, enabling businesses to navigate through periods of lower revenue without compromising their operational stability. The best approach is to allocate a portion of the profits earned during peak seasons into this reserve. By doing so, businesses ensure they have funds available to cover essential operating expenses, such as rent, utilities, and payroll, during off-peak periods. This practice is crucial for maintaining continuity and avoiding the stress of financial shortfalls.

The size of the cash reserve ideally should be substantial enough to cover operating costs for a period ranging from three to six months. This timeframe provides a reasonable buffer to manage through slower business phases or unexpected downturns. Additionally, having a cash reserve also offers businesses the flexibility to seize opportunities that may arise, such as investing in marketing efforts or capitalizing on unforeseen market demands. In essence, a well-planned cash reserve is not just a defensive measure against financial unpredictability but also a tool for proactive business growth.

To summarize, mastering cash flow management is essential for the survival and growth of a seasonal business. By implementing strategies such as effective forecasting and budgeting, diversifying income streams, managing inventory, optimizing receivables, choosing the right financing options, controlling expenses, and building a cash reserve, business owners can overcome the challenges posed by seasonality. These approaches not only ensure financial stability but also pave the way for a more resilient and prosperous business model.